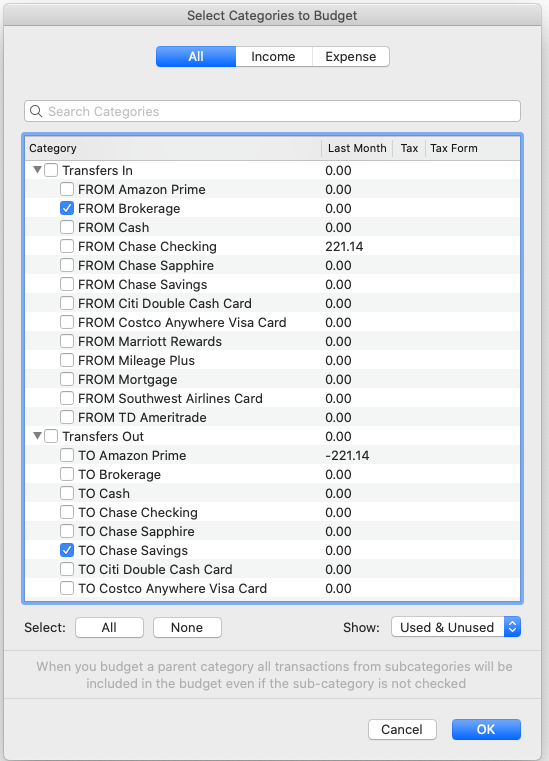

By categorizing your income and expenses, you can fill out those diabolical tax forms in minutes rather than days. Think about filling out an income tax return and you’ll quickly see the benefit of using Quicken categories. Then, when you transfer money ( Transferring Money Between Accounts) from checking to savings or make a mortgage payment, you use these Transfers and Payments categories to show which accounts the money is going into and out of.Ĭategory.

Quicken automatically creates a third type of category, Transfers and Payments, which works a little differently: Quicken generates categories representing each of your accounts (checking, savings, IRA, and so on). Expense categories represent the money you spend, including unavoidable expenses like electric service and discretionary expenses like the cost of your skydiving hobby. Income categories are for the money that comes into your personal coffers, like salary, part-time income, and winnings from the gals’ bunko game. As you’ll learn shortly ( Creating a New Category), when you create a category, you specify whether it represents income or an expense.

Quicken medical expense manager configuration how to#

If you decide to use tags to analyze your income and expenses, you’ll learn how to set them up, too. Then, if the category list Quicken sets up for you isn’t enough, you’ll learn how to add built-in Quicken categories to the list or create your own. You’ll learn about the types of categories Quicken has, from broad groups for mandatory and discretionary spending to detailed subcategories. This chapter starts by explaining what categories and tags can do. The program also includes another feature, called tags, to help you slice and dice your information in ways that categories only dream about. If Quicken doesn’t come with a category you want, creating new ones is easy. You may have a shoe fetish that warrants tracking how much you spend on footwear, whereas your best friend tracks horse shoes, hay, and vet bills. You can turn Quicken’s built-in categories on and off to track different types of income and spending as changes like these happen.Īt the same time, everyone has a personal peccadillo or two. Or perhaps you’re now even renting out condos. That apartment you had when you first created your Quicken data file? Gone, replaced by your own home.

If you do a good job of categorizing each entry (and Quicken makes it dead simple), then you’re never more than a click or two away from generating reports that answer questions like, “How much did taxis cost me this year?” and “Do I spend more on my Chihuahua or my child?” When you create a new Quicken data file, the program automatically sets you up with a boatload of categories, based on what you tell it during setup (such as your marital status and whether you own a home).įor most of us, our financial needs change as time passes. Chapter 4. Categories and Tags: Tracking TransactionsĪs you learned in Chapters Chapter 1 and Chapter 2, Quicken lets you assign categories to financial transactions to help you track what you’re spending your money on, prepare your tax returns, and so on.

0 kommentar(er)

0 kommentar(er)